You are viewing this site in certification mode

Execute large orders with minimal market impact through Europe's pioneering auction mechanism that rewards size over speed.

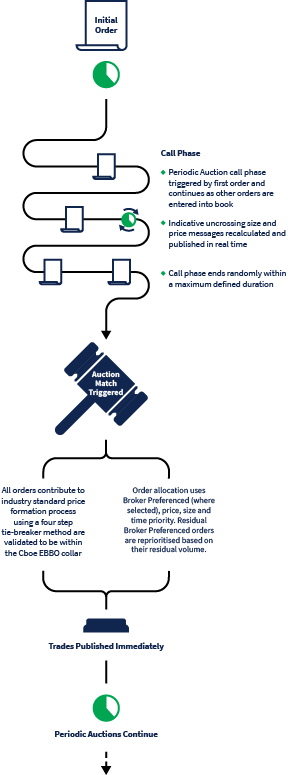

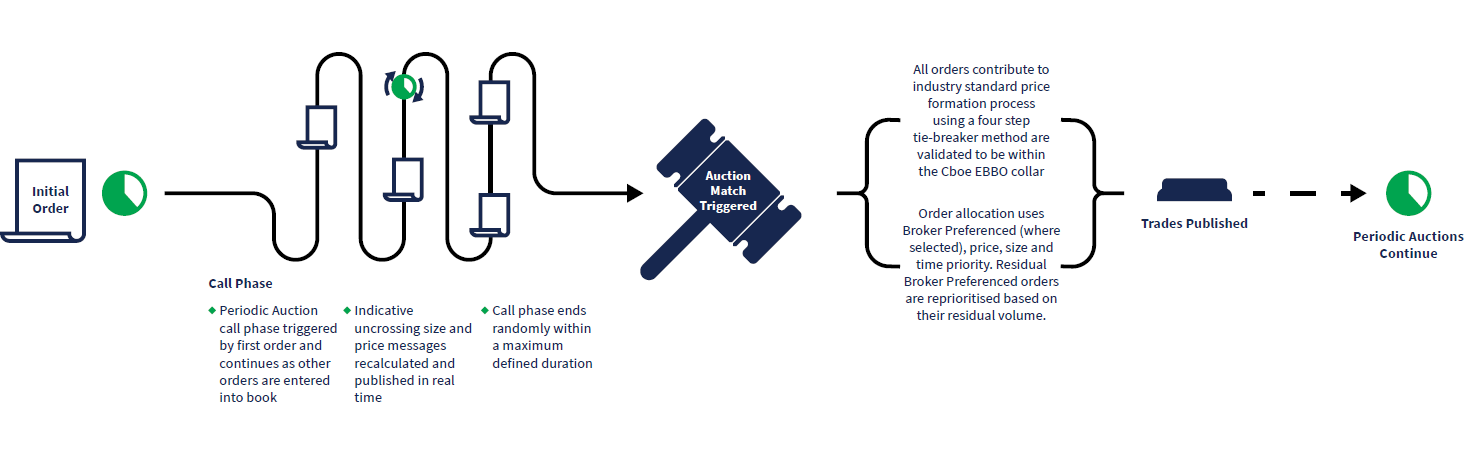

The Periodic Auctions Book provides a reliable place to execute orders within the Cboe EBBO, combining true price formation with an execution model that rewards larger orders. As Europe's pioneering periodic auction mechanism, it delivers the transparency required by MiFID II (in accordance with RTS 1) while protecting your trading intentions.

All order types match against any other type. Orders are submitted individually with no paired submission capability.

Triggered by first order, continues as orders enter.

Dynamic pricing using all book orders.

The Periodic Auctions Book (PAB) integrates seamlessly with Cboe's sweep order functionality, allowing you to check for liquidity across our Dark book before accessing PAB, or sweep from PAB to Lit markets—all with a single order entry.

Available sweep types include:Existing Participants connected to BXE and DXE can enter orders into the book by simply using FIX tag 9303=BP. Participants can leverage the same clearing arrangements, connectivity and FIX or BOE ports for order entry for the Periodic Auctions book.

We provide transparency into the data behind our Periodic Auctions book by posting statistics for broker priority allocations. The following table shows the percentage of notional executed on Cboe Europe Periodic Auctions which are broker priority allocated.

| Cboe NL | Cboe UK | |

| 2019 | N/A | 22.5% |

| 2020 | N/A | 18.7% |

| 2021 | 18.5% | 18% |

| 2022 | 17.7% | 15.4% |

| 2023 | 15.4% | 13.5% |

| 2024 | 11.4% | 9.8% |

| H1 2025 | 6.3% | 5.7% |

| Q3 2025 | 5.5% | 4.4% |

| Sept- 2025 | 4.9% | 4.2% |

Dive into our expert-led video series to learn how the Book operates, why it matters, and how it’s driving better outcomes for market participants.