You are viewing this site in certification mode

Midpoint Discretionary Order (MDO) is a patent-pending feature having a blended order type that incorporates the characteristics of Primary Peg, Midpoint Peg and Discretionary orders. Members can use MDOs to post displayed or non-displayed liquidity at the National Best Bid/National Best Offer for Buy/Sell orders with a discretionary range extending to and including the NBBO midpoint. MDOs do not execute at a price more aggressive than the NBBO midpoint. MDO is available on EDGA and EDGX exchanges, providing the opportunity to use MDOs in two different trading markets that offer comparable MDO advantages, but also provide a few distinguishing characteristics to meet varying needs of investors.

Members may send an MDO on EDGA and EDGX using either FIX or BOE, utilizing the following instructions:

| BOE Field | FIX Tag | Req'd | Comments |

|---|---|---|---|

| ExecInst | 18 | Y | d = Midpoint Discretionary Order |

| OrdType | 40 | Y | P = Peg |

| Display Indicator | 9479 | Y | v = Visible (Default) I = Invisible |

| RoutingInst | 9303 | Y | B = Book Only (EDGA) P = Post Only (EDGX) |

| Price | 44 | N | Optional Cap Price |

| Note: Time in Force using IOC or FOK instructions will be rejected. | |||

Quote Depletion Protection (QDP) is a patent-pending process including an optional instruction that market participants can use with MDOs on either Cboe's EDGX™ or EDGA™ Equities Exchanges. When activated, QDP will disable the discretionary range of MDOs for a short period of time in order to prevent executions at prices more aggressive than their ranked price when an execution of the exchange's quote indicates that the market may be moving against a resting MDO. QDP provides investors with an additional trading tool to protect against such adverse selection risk and enhance trading outcomes when using MDOs.

In addition to QDP, Cboe will now allow MDO orders to include offset instructions. This will allow MDOs to be ranked at prices less or more aggressive than the NBB for buy orders or the NBO for sell orders, while still maintaining discretion to the NBBO midpoint, consistent with their limit price.

Highlights of MDO with QDP:

MDOs can be specified by populating Tag 18 (ExecInst) with one of the following values:

Offsets may be included in Tag 211 (Peg Difference):

Book Only and Post Only Routing Instructions in Tag 9303:

QDP Active Period = 2 milliseconds

NBBO: $10.00 x $10.01

Order 2, which is an MDO to buy, is ranked at $9.99 non-displayed with discretion to the midpoint price of $10.005. When Order 3 is entered it will trade a single share with Order 1 at $10.00, triggering a QDP Active Period for Order 2 because of the execution of the EDGX Best Bid below one round lot. This restricts the ability for Order 2 to exercise discretion for two milliseconds, and prevents the execution of Order 4 within Order 2's discretionary range. As a result, the Order 4 would be cancelled without an execution.

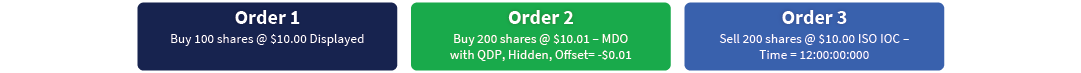

QDP Active Period = 2 milliseconds

NBBO: $10.00 x $10.01

Order 2, which is an MDO to buy, is ranked at $9.99 non-displayed with discretion to the midpoint price of $10.005. When Order 3 is entered it would first trade 100 shares with Order 1 at $10.00. A QDP Active Period is then immediately enabled for Order 2 because of the execution of the EDGX Best Bid below one round lot. This restricts the ability for Order 2 to exercise discretion for two milliseconds, and prevents the execution of the remaining 100 shares of Order 3 within Order 2’s discretionary range. As a result, the remaining quantity of Order 3 would be cancelled.

Book Only MDO with QDP executes with midpoint order after QDP period expires

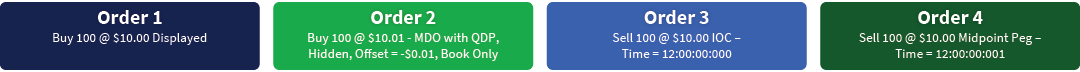

QDP Active Period = 2 milliseconds

NBBO: $10.00 (Cboe Bid=0) x $10.01

Order 2, which is an MDO to buy, is ranked at $9.99 non-displayed with discretion to the midpoint price of $10.005. When Order 3 is entered it will trade 100 shares with Order 1 at $10.00 triggering a QDP Active Period for Order 2. Order 4, which is a Midpoint Peg sell order, arrives while QDP is still active for Order 2 and posts to the book at 10.005. Order 2’s discretionary range is reinstated after the QDP Active Period expires and trades 100 at $10.005 with Order 4.

Please contact the Cboe U.S. Equities Trade Desk ([email protected], 913.815.7001) or your Director of Sales with any questions. We appreciate your continued support of Cboe and look forward to earning more of your business.